Car loan borrowing capacity

For most lenders the minimum amount you can borrow for a car loan is 5000. A loan term is the duration of the loan given that required minimum payments are made each month.

Can A Car Loan Keep You From Getting A Mortgage Real Estate News Insights Realtor Com

PakWheels Car Loan Calculator helps you compare the Best Car Financing solutions that enable you to buy your dream Car on Installments.

. Home Loan Gold Loan Car Loan Two. Mortgage release through e-mail or Emirates NBD Call centre. A car loan is a contract between you and a lender where they agree to provide you with the cash to buy a new or used car and you agree to pay the money back over time.

The lower the interest rate the higher your borrowing capacity as the total amount of interest applicable to the entire life of the loan will be lower assuming interest rates. Capacity collateral capital. Mention Auto loan Agreement ID or 20-digit Auto loan account number along with the registered mobile number.

Youll need to decide if you want it to be a secured car loan or unsecured car loan. This is because the average interest rate for both car loans and personal loans is different. Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase.

A car loan calculator and a personal loan calculator are very similar apart from one key feature. A line of credit is a preset borrowing limit that can be used at any time paid back and borrowed again. Borrowing money to buy a car is a managed risk for both you and the lender.

Use Canstars home loan selector to view a wider range of home loan products. The maximum loan amount you may be eligible for based on your credit score income. The term payday in payday loan refers to when a borrower writes a postdated check to the lender for the payday salary but receives part of that payday sum in immediate cash from.

The loan tenure and your capacity to repay. Compare rates from the top banks in Pakistan. Compare Best Car Loan Interest Rates in.

Loan rates and terms applicable to new vehicles only. Should meet the minimum repayment capacity or minimum salary requirements. If youre borrowing money for personal uses secured loan options can include.

And a repayment tenure of up to 8 years you can find the most suitable car loan for your needs at BankBazaar. Latest news on economy inflation micro economy macro economy government policy government spending fiscal deficit trade trade agreement tax policy indian. For a term of 60-months based on new car rate of USEDREFINANCE.

A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property. Capacity collateral capital and conditions. How the interest rate and loan term can impact your borrowing power.

As a car loan is typically secured against the vehicle and secured loans generally come with lower interest rates. The value of the car can be. The same would be true with a car loan.

The default interest rate. Borrowing a lesser amount and paying it off. The term of the loan can affect the structure of the loan in many ways.

ÿÿ3eÌHLRžÚ uüùóïO àøÿÿ4-VÝát¹¹xzyûøúù²ëkÕ î16¼IBþ ú1y ÎþÔê 84ÝêöPµëÞûgúÿkýIǺ² 6 ƒdµÁŠuÙºjÙ¼Mi l ¼Ø ÊÔÿå0MÅýÔâS õá ȪíÙé 4cëH9JgWÅ Y ŠïÜÇŸd eÿ þÊ7cÌ GëÍQ2gb 9ÔVý ûlfOFgFÿœ. Five Cs Of Credit. 835 and calculate your EMI by using our car loan calculator.

You can release the mortgage on your car through e-mail to email protected or Emirates NBD call centreThis service is free of cost. Buying or investing in a new property we have a variety of tools and calculators to. The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to.

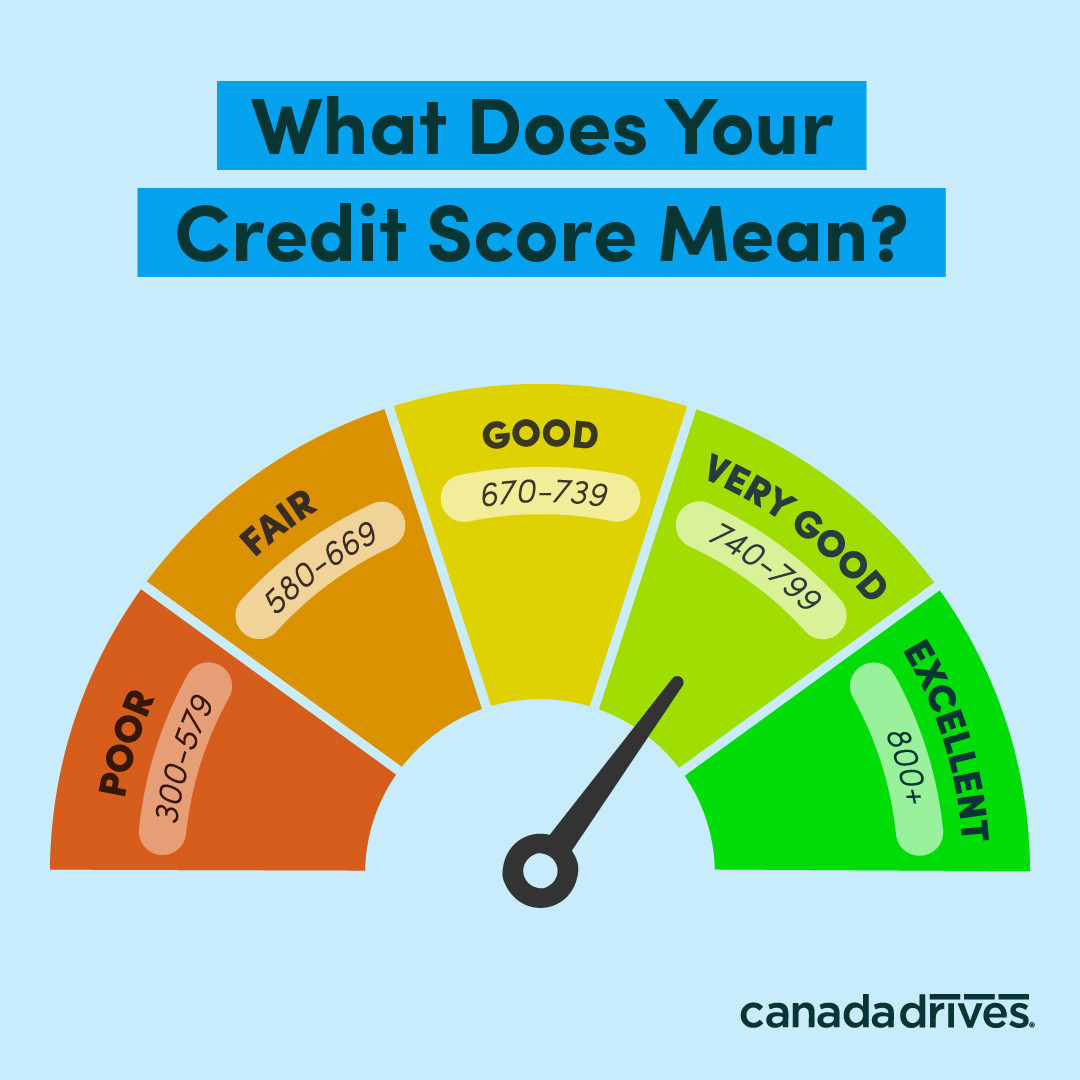

If you have a high credit Score you can negotiate on the interest rate on future loans. Generally the longer the term the more interest will be accrued over time raising the total cost of the loan for borrowers but reducing the periodic payments. The five Cs of credit is a system used by lenders to gauge the creditworthiness of potential borrowers.

A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral. The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. Car Loan - With interest rates as low as 700 pa.

You can take the loan for 90 to 100 of the on-road price of the car. Minimum auto loan amount is 3750. Car loan EMI calculator lets you know your car loan EMIs based upon the loan amount tenure and interest rate.

Before committing to a particular home loan product check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. What are the documents required for small amount personal loan. For 1000cc or lower engine capacity cars minimum 15 of total car value is required as down payment and for 1000cc above cars 30 down payment is required.

Many lenders will allow you to borrow up to 100 of the vehicles purchase price however other factors like your income employment history and credit score can affect your borrowing capacity. Unless you get a 0 financing deal youll have to pay interest each month on the loan balance. New vehicles are defined as the current or previous model year vehicle with less than 5000 miles.

For expert impartial car financing advice call 03-111-222-461. Changing the interest rate and loan term can have a significant impact on your borrowing power. For example personal loans are shorter tenure loans up to a maximum of 5 years whereas home loans are longer tenure loans which can go up to a maximum of 25-30 years.

Loan principal and also the lender you are borrowing from. Rate applies to loan amounts up to a maximum of 100000. A number of banks offer refinancing option or borrowing an additional loan over an allotted second-hand car loan.

For instance a car loan is secured by the vehicle. Car Loan also auto loan car financing. Credit Score Borrowing a loan from a registered lending portal also improves your credit score.

Compare home buying options today. A payday loan also called a payday advance salary loan payroll loan small dollar loan short term or cash advance loan is a short-term unsecured loan often characterized by high interest rates. Thats why lenders offer different two basic types of loans a.

Apply for Car Loan online at lowest interest rate ie. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. The system weighs five characteristics of the borrower and conditions of.

Send the request from the e-mail address registered with the bank.

12 Month Introductory Rate Special P N Bank The Borrowers Home Loans Personal Loans

Do You Have Enough Income For An Auto Loan

Car Loan With Personal Loan Positive Lending Solutions

Canada Car Loans Everything You Need To Know Canada Drives

/ScreenShot2021-02-11at2.44.20PM-3933e74eff3449b3943ca3cc58cd11c0.png)

Auto Loan Balances Hit 1 36 Trillion In 2020

/shutterstock_123911596.car.auto.loan.cropped-5bfc31edc9e77c005878377f.jpg)

Auto Loan Balances Hit 1 36 Trillion In 2020

%20(1).png)

Car Loan Calculator Car Loans Canada

3 Factors Affecting Your Car Loan Payment Credit Karma

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at2.44.20PM-3933e74eff3449b3943ca3cc58cd11c0.png)

Auto Loan Balances Hit 1 36 Trillion In 2020

Free Printable Loan Agreement Form Form Generic

Car Loans 101 How To Calculate Your Monthly Payment In Seconds

How Much Car Can I Afford Based On My Salary Finder Canada

Auto Loan Calculator Calculate Car Loan Payments

7 Basics Of Financial Success Forum Credit Union Http Www Forumcu Com Saving Money Chart Financial Tips Money Management

How To Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

Can I Get A Car Loan After Bankruptcy The Ins Outs Debt Ca

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips